By Chris Edward

UK Country Manager

Lombard International Assurance

eprivateclient.com

p. 8-10

If you ask someone ‘what’s Switzerland famous for?’ they would most probably respond, in this order or another: chocolate; watches; cheese; Roger Federer; the Alps; and, of course, privatebanking.

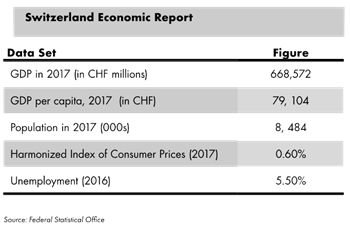

Swiss banks have long been a symbol of quality service and excellence and have set the bar high in global private banking and wealth management. A 2018 Deloitte survey[1] ranking international wealth management centers showed that Switzerland was and remains the world’s largest wealth management center for international assets, despite increasing competition from other international hubs.

Traditionally the key elements that have attracted wealthy individuals around the globe, including UK nationals, to Switzerland are the country’s political and economic stability, security and its ability to offer international investment quality and diversification. For many, there has also historically been a prestige associated with holding an account with a Swiss bank. This prestige was based on the strong reputation of service excellence of these institutions.

This profile has been put to the test in the last decade as Switzerland has fought to combat being identified as a hub for individuals hiding their assets there and not declaring these in their country of residence. Significant steps have been made to overcome this stigma.

With the introduction of the Common Reporting Standard (CRS), greater transparency and more rigorous procedures, Switzerland is now one of the most stringent global financial hubs with regards to anti-money laundering rules and compliance.

This is not the only important step the Swiss financial industry has taken to stay in the lead. The main Swiss banks leading the country’s wealth management industry have responded well and

adapted to the increasingly globalised nature of wealth. Based on their strong reputation of service excellence, these institutions have targeted the most promising global regions such as Asia and Latin America, while adapting business models to be compliant in the international environment. This approach has been successful, and according to an AUM-based ranking from Asian Private Banker[2], at end of 2017 UBS was the largest private bank in Asia (excluding continental China), Credit Suisse was third and Julius Baer fifth.

According to the same Deloitte survey,

Switzerland also consistently ranks top for infrastructure, including digital, and its attractiveness as a travel destination. The latter of these becomes relevant for those who expatriate their wealth to Switzerland, with the possibility of, at some point, following it. It is also ranked alongside Singapore and Luxembourg as a leading financial centre in terms of political certainty, a consideration which has grown in importance for HNWIs in an environment of increased global political ambiguity. And the country also scores well for monetary stability.

It comes as no surprise then that political and economic uncertainty in the United Kingdom has led to inflows into Switzerland as HNWIs search for the stability that the country offers.

An older generation of UK residents will remember the capital control era of the 1970’s. These controls limited the ability to move money in and out of the country, and prevented UK residents from buying property abroad or purchasing foreign equities. This also made it difficult for foreign companies to move money back to their home countries, and so many were reluctant to invest in the UK. A change to a Labour government in the UK, with a possible subsequent return to capital controls, could mean a capital flight on the pound.

Faced with this political uncertainty, many UK HNWIs and UHNWIs are planning ahead and moving their assets to ‘safer’ jurisdictions for peace of mind. Holding assets in these jurisdictions and in different currencies significantly mitigates against risk in the event of a run on Sterling. Further, the rational for these individuals of sending capital abroad now is that if a political shift does occur in the UK they can follow their capital.

At Lombard International Assurance, we have seen a trend with some UK clients moving their funds out of any UK linked jurisdiction, in terms of Brexit and the political situation in the UK we have seen a large number of UHNW individuals simply leave the UK altogether.

At the forefront of decision making when it comes to wealth protection is stability and economic security, as well as access to international asset management diversification and expertise. Switzerland will remain a leading beneficiary in the transfer of funds from wealthy individuals primarily because of the security it offers those who wish to preserve their wealth for future generations.