The Swedish National Debt Office has published the Governmental borrowing rate as of 30 November 2024, which amounts to 1.96%. This means an effective yield tax for life insurance policies of 0.89% for income year 2025.

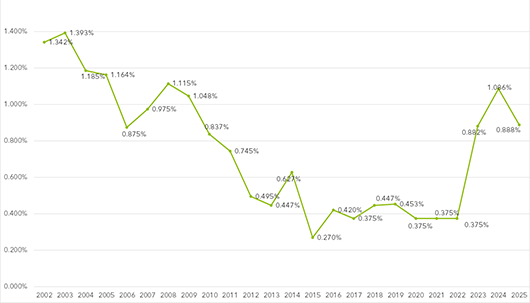

Historical graph of the effective yield tax up to 2025

Click here to see a full-sized version of the graph

Since 1994, life insurance policies have been taxed at a standard rate by levying an annual yield tax. Since 2012, assets in investment savings accounts (ISK) have been taxed in a similar way through a standard levying of income tax.

For both forms of savings, assets are taxed as if they yield a presumed return each year corresponding to the Governmental borrowing rate (GBR) as of 30 November of the previous year. This standard presumed return is taxed with a capital income tax of 30%.

As of 1 January 2018, the calculation basis for taxation of both investment models is based on GBR + 1%. The lower threshold of 1.25% for calculating the tax, which was introduced from 1 January 2016 still applies.

On 28 November 2024, the GBR amounting to 1.96% for income year 2025 was published, which will form the basis for the taxation of life insurance policies and ISK.

Based on the GBR of 1.96%, the effective yield tax for life insurance policies amounts to 0.89% ((1.96% + 1%) x 30%) of the value of the life insurance policy as of 1 January 2025 + the full value of premiums paid up to and including 30 June 2025 and half the value of premiums paid between 1 July and 31 December 2025.

Due to the decreased interest rates on a Swedish, as well as global basis, during 2024, the yield tax for income year 2025 has decreased compared to the previous year.

With a more attractive level of taxation, the added succession and portability planning opportunities and ease of administration, we believe that life insurance policies continue to be a very attractive investment vehicle.

Combined with the possibility to hold private equity and a wide range of both quoted and unquoted investments, life insurance policies continue to be an attractive long-term investment tool for managing your assets.

Download this newsflash as a PDF

Download this newsflash as a PDF