Article initially published in the print version of The Property Chronicle.

Wealth managers and advisers must attune themselves to the needs of each demographic

Who is Vitalik Buterin? While most of us have just about familiarised ourselves with blockchain technology and its uses, not everyone has heard of Vitalik Buterin and fewer still will have reflected on the fact that, at 24 years of age, the millennial millionaire creator of Ethereum (a blockchain-based system that might help revolutionise financial services and other industries) already belongs to a previous generation.

In today’s ever-changing world, things move fast; so fast that it is difficult to keep up with new trends and their related opportunities, especially in the rather traditional world of financial services.

But, with five generations of investors active in the financial markets, and Generation Z set to overtake Millennials in number, to represent 40% of consumers by 2020 [1]. Wealth managers and advisers must attune themselves to the needs of each demographic and adapt to how younger generations view the world, in order to stay relevant

Understanding evolving attitudes

Attitudes to investing have changed. When asked how they would invest a USD 10,000 gift, a third of Baby Boomers said they would pay off debt – a figure that fell to 25% for Generation X and around 22% for Millennials [2].

When it comes to risk, around half of Baby Boomers and Millennials recognise that global economic instability is a concern although 40% of Millennials say they would invest more in response to 20% a fall in the value of their investment, compared to 23% of Baby Boomers [3]. In practice, however, younger generations prove less patient in times of volatility, with 15% of Millennials having made quicker, potentially less-considered, changes to their portfolios in response to political or stock market instability (15% for Generation X and 7% for Baby Boomers) [4].

These preferences are broadly reflected in portfolio composition. Research by Legg Mason showed that, in 2018, Baby Boomers and Millennials held around 30% in cash, while Millennials were less inclined toward equities but heavier in alternatives (11% as compared to 7% for the previous generation). Newer investments such as cryptocurrency are gaining ground, with 23% of Millennials holding the asset class compared with 19% in the previous generation and only 8% among Baby Boomers [5]. However, research also shows that the younger the generation, the less time investments tend to be held (just under two years for Millennials [6]). Meanwhile, sustainability is becoming increasingly important: Millennial and Generation Z investors are more selective in this context but they are also willing to pay above the odds and invest for longer if wealth will ultimately reach responsible companies or achieve ESG goals [7].

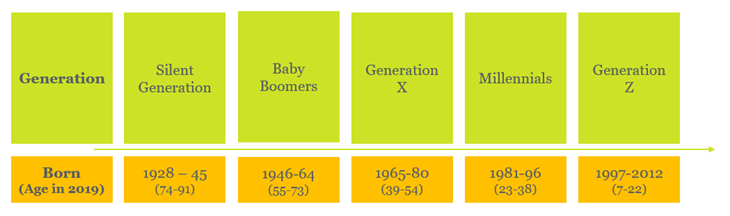

There is limited consensus on the years that each generation includes.

There is limited consensus on the years that each generation includes.

The diversity of attitudes is influenced by the environment from which each generation has emerged. Baby Boomers have post-depression and post-war roots – a background that influenced Generation X who in turn grew up in a time of transition and, later, relative prosperity. While Millennials may have been born into this prosperity, they began their careers in the Great Recession and this has become formative for Generation Z. The youthful optimism we perceive in recent generations is also likely a question of experience and memory: Millennials have never lived in a period of global conflict or in a time before European integration, while most of Generation Z has no memory at all of the September 11 attacks that launched the war on terror.

Differences in investment approach also reflect the amount of time each demographic believes it has left, with older generations often demonstrating a shorter term outlook designed to preserve accumulated wealth, while younger generations have the benefit of a longer investment horizon during which to create or recreate the legacies they ultimately wish to pass on.

The immovable need for advice

The way in which financial services are accessed has also transformed. As Millennials reach their peak earning age, robo-advice is becoming prevalent. The tech-pioneers of the late twentieth century, they predictably embrace automation and control: 67% seek some form of computer-generated advice as a core service and 72% describe themselves as self-directed in relation to their wealth [8]. Generation Z has never known a time without mobile phones, advanced computing and the internet. Tech-innate, investors in this bracket can be equally at ease turning to social media contacts and influencers for inspiration.

However, technology is unlikely to entirely displace more traditional advisory models. Millennials and Generation Z admit to being less financially knowledgeable than their predecessors and they continue to value personal contact and sound guidance. Half of Millennials need help assessing risk and nearly as many need tax planning advice, 28% need assistance with basic budgeting and debt management and the same proportion are already in search of estate planning advice [9]. In the meantime, individuals are increasingly mobile and invest abroad more readily, while family structures are becoming more colourful and complicated. No level of automation can interpret the intricacies of cross-border planning, help handle the softer issues such as family dynamics or articulate a family’s values and objectives. At least not yet!

So, where do we go from here?

Advisers, wealth managers and product providers should be alive to the identity and attitudes of each slice of the population, recognising how their investment styles and other preferences differ from those in adjacent generations; innovation – particularly in the digital sphere – will continue to be key if we are to meet client needs and expectations; and solutions that offer diversification and control, that consolidate investments under a single umbrella, and that remain agile and adaptable as client circumstances evolve are likely to have the upper hand. Next stop: Generation Alpha.

|

Simon Gorbutt

Director Wealth Structuring Solutions

Lombard International Assurance |

Source:

[1] Generation Z: Unique and Powerful, MNI Targeted Media Inc.

[2] 2018 study by LendEdu

[3][7] Legg Mason Global Investment Survey 2018

[4][5][6] Schroders Global Investor Study, 2019

[8] Millennials and Money, Accenture 2017

[9] Breaking the Millennial Myth, Natixis 2017